HOME ICT COMPUTERISED ACCOUNTING CAD CODING SAP CONTACT

0722838044

|

|

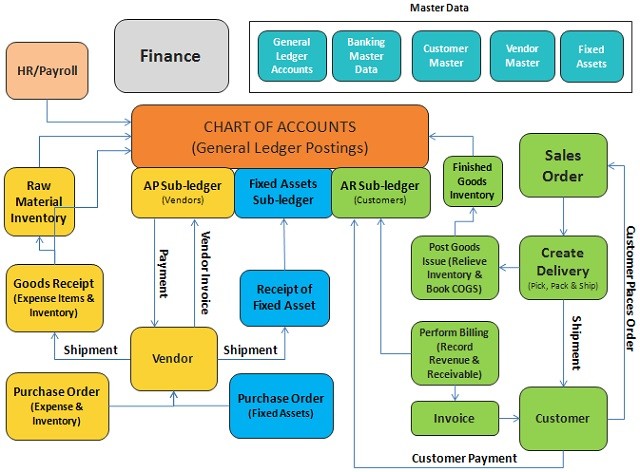

Why Choose SAP (FICO) Fast Track Training?SAP(FICO) being the most demanded SAP skill worldwide. With more than 10,000 jobs currently available worldwide FICO is the biggest job provider on the SAP job market. As we know, from Financial Accounting to Production Planning, there are many highly demanded SAP skills. FICO has been the top ones in terms of SAP job openings. The countries with the highest hiring demand in terms of SAP FICO Jobs are United States, Germany, India and United Kingdom. What is it ?SAP Finance and Controlling(SAP FI) is based on pure accounting principles which provides core accounting and reporting capabilities and ensures the most up-to-date balances and reporting accuracy through complete integration between the General Ledger (GL) and the Accounts Receivable (AR) and Accounts Payable (AP) and Asset Accounts (AA). Its flexible configure as per country specific standards of Reporting, Tax and Depreciation. The SAP FI module is the Core Module in SAP ERP it integrates with other modules such as Controlling, Sales and Distribution, Purchasing and Materials Management and Human Resources. Document transactions occurring within these modules generate account postings via account determination tables. Reports of this Modules are user for external purpose such as Balance sheet and Profit and Loss of each financial year. Who Is It For?

SAP Study OptionsInstructor Led Live SAP Online TrainingStudents attending training through Online LIVE Training have a real time, Live Instructor Led student experience through our Virtual Learning Campus. Online LIVE Training provides an engaging live classroom environment that allows students to easily interact with instructors and fellow students in-person virtually. Classroom-Based SAP Live TrainingWe offer evening sessions for classroom based training, where an experienced Tutor/Consultant goes through the whole SAP Training course in our London campus. Entry RequirementsAnyone with basic IT knowledge and good communication skill in English can join. We also recommend having some reasonable accounting knowledge before you start the course. Course Syllabus – SAP Fast Track Training (FICO)This FICO Consultant package prepares you for the SAP FICO consultant certification exams. The Course Package covers the complete exam topics for FI Consultant C_TFIN52_66 – SAP Certified Application Associate – Financial Accounting, and the complete exam topics for CO Consultant C_TFIN22_66 – SAP Certified Application Associate – CO Management Accounting. During the training you get access to Sap sandbox which continues even after training finishes. You receive a certificate once you finish the course, you can also do an external exam to receive certification from SAP (Optional) for details on exam booking you may visit SAP website. |

Class Timings

Monday – Friday: 07:00AM – 08:00PM

Saturday: 08:00AM – 01:00PM

Sunday: Closed

About Montech

As one of Kenya's leading tertiary education providers, Montech offers a personalised experience enhanced by world-class programs and innovative digital engagement. We lead by creating opportunities to live and work in a connected, evolving world.

Copyright © Montech Training Centre. All rights reserved